RESIDENTIAL ASSET CLASS: December 2022 CSEE NEWS

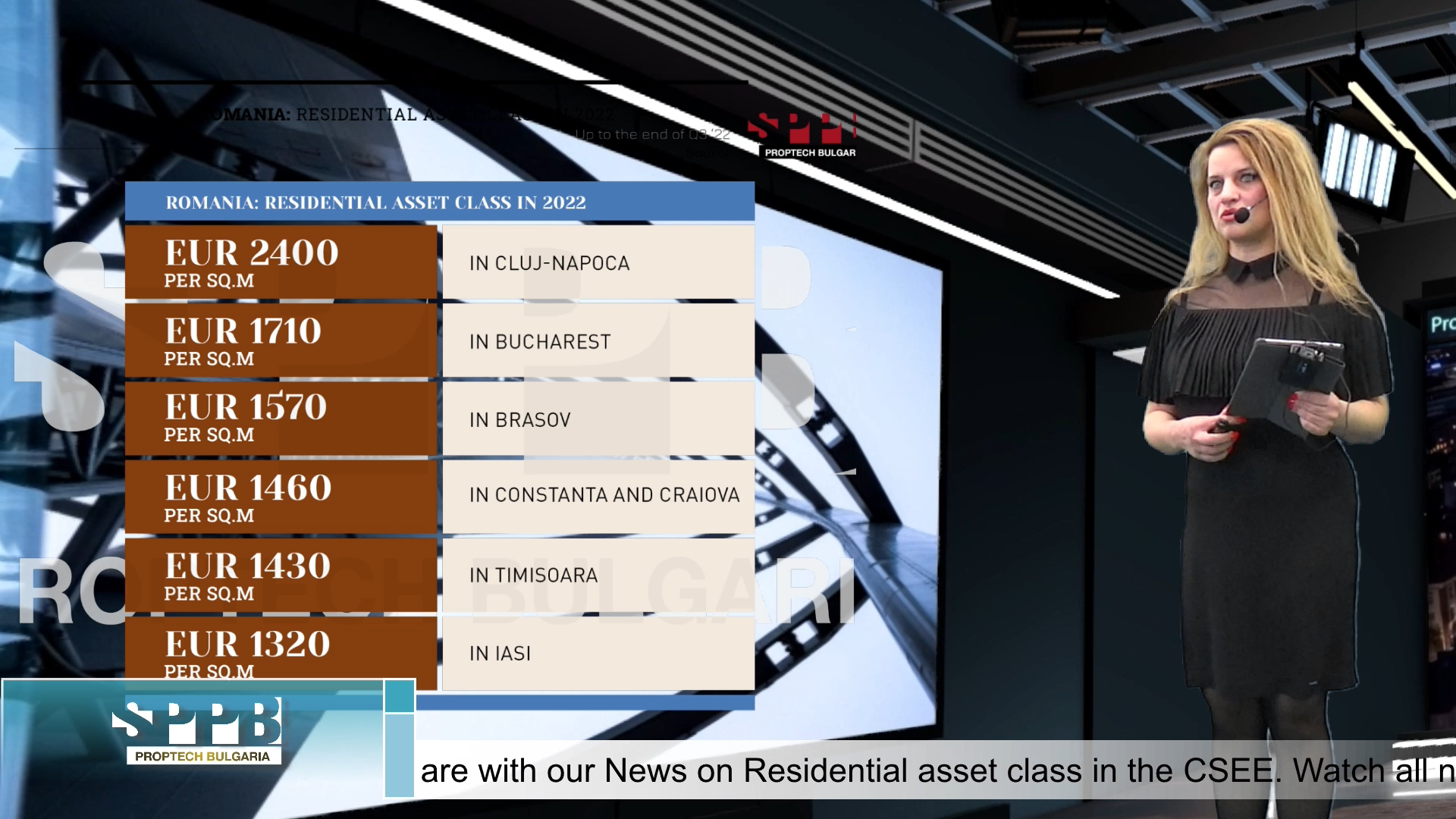

In Romania, Residential developers have been the most active in terms of land acquisitions in the past 2.5 years, as they secured land plots which allow the construction of more than 30,000 units in all parts of Bucharest, according to data from real estate consultancy Cushman & Wakefield Echinox.

Total land transactions on the Bucharest market amounted to €720 million between 2020 and the first half of 2022, up almost 50% compared with the previous five semesters.

Industrial and logistics players concluded land transactions for an area totaling over 1.2 million sq. m in the same period, on which over 500,000 sq. m of industrial and logistics spaces could be developed.

Moreover, the retail chains such as Kaufland, Lidl, Rewe (Penny), continued to buy new land plots, aiming to expand their local networks.

The total transacted area amounted to approximately 470 hectares in the analyzed period, with 85 transactions being considered at an average value of €8.5 million euros per deal.

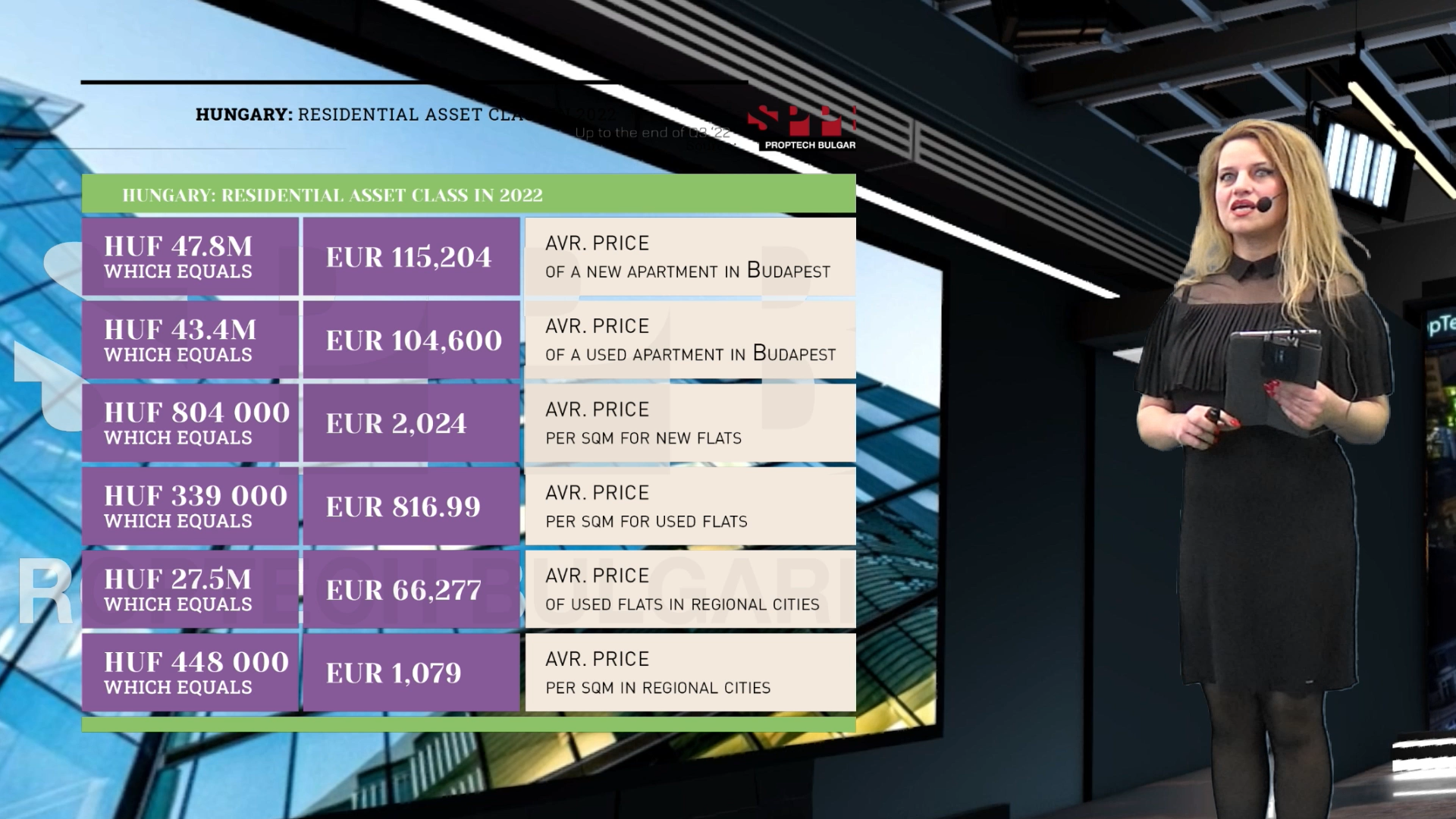

In Hungary, Chinese, German and Dutch buyers remain active in the residential market in Hungary, especially in Budapest and some popular touristic regions. The weakening local currency makes homes even more attractive to invest in. Property Forum talked to László Balogh, Chief Economist at ingatlan.com, Hungary’s largest listing platform, about the latest trends and the possible new wave of foreign buyers coming to the country.

Foreign private investors seem to play a larger role in the residential market again. What is the major drive for those who put money in that real estate segment in Hungary?

Foreign buyers are very popular among Hungarian sellers. Their major drive is the low price of Hungarian real estate assets. Those investors who are willing to pay in USD or EUR could see a 10-15% cut-off in Hungarian property prices in 2022 because of the FX-rate changes.

Some of the core investor nations have disappeared or are way back on the top list compared to the first decade of this century. What are the major changes on the list over the past 3-4 years?

On average 5% of the buyers come outside of Hungary. The latest official statistics on foreign property buyers are available for 2020. The biggest source country of foreign buyers was Germany, Slovakia, Romania, China, and Austria that year. These countries were in the TOP5 in the previous years as well.

In Poland, like years ago, the Polish Private Rental Sector is going through a blooming time as each commercial real estate sector segment. It requires a unification of offers, greater standardization of available space, and self-professionalization. One of the first spectacular transactions involving the PRS was in 2016 and the purchase of 72 apartments in the Złota 44 building in Warsaw by the German investment fund Catella Residential Investment Management. At the end of September 2022, this segment is formed by an offer of more than 8,500 apartments for rent spread across Poland’s largest cities. The prospects for the development of the market remain very high, and it is mainly favoured by market conditions and the structure of the residential sector in Poland. AXI IMMO, together with industry experts Inquiry and ThinkCo, presents data for the Polish institutional rental market in a publication, “Development prospects for the PRS market in Poland.”

The PRS (Private Rental Sector) market, or so-called institutional rental, is relatively new to the Polish real estate market. The segment has been formulating for about six years, and the most active purchases, acquisitions, or new listings were the last two, i.e., 2020 and 2021. During this time, a real boom in investment in the sector was registered, with, among others, Aurec Capital creating the LivUp brand, acquiring three properties in Warsaw (over 400 apartments), and Zeitgeist Asset Management purchasing four buildings under construction in Gdańsk with over 200 apartments. In turn, Swedish fund Heimstaden Bostad acquired 640 apartments in Warsaw (Praga Północ and Służewiec) from Eiffage in 2020 and bought more than 3,000 units a year later from Marvipol and Budimex. Also, in 2021, Nordic fund NREP acquired more than 1,000 apartments in Warsaw from YIT.

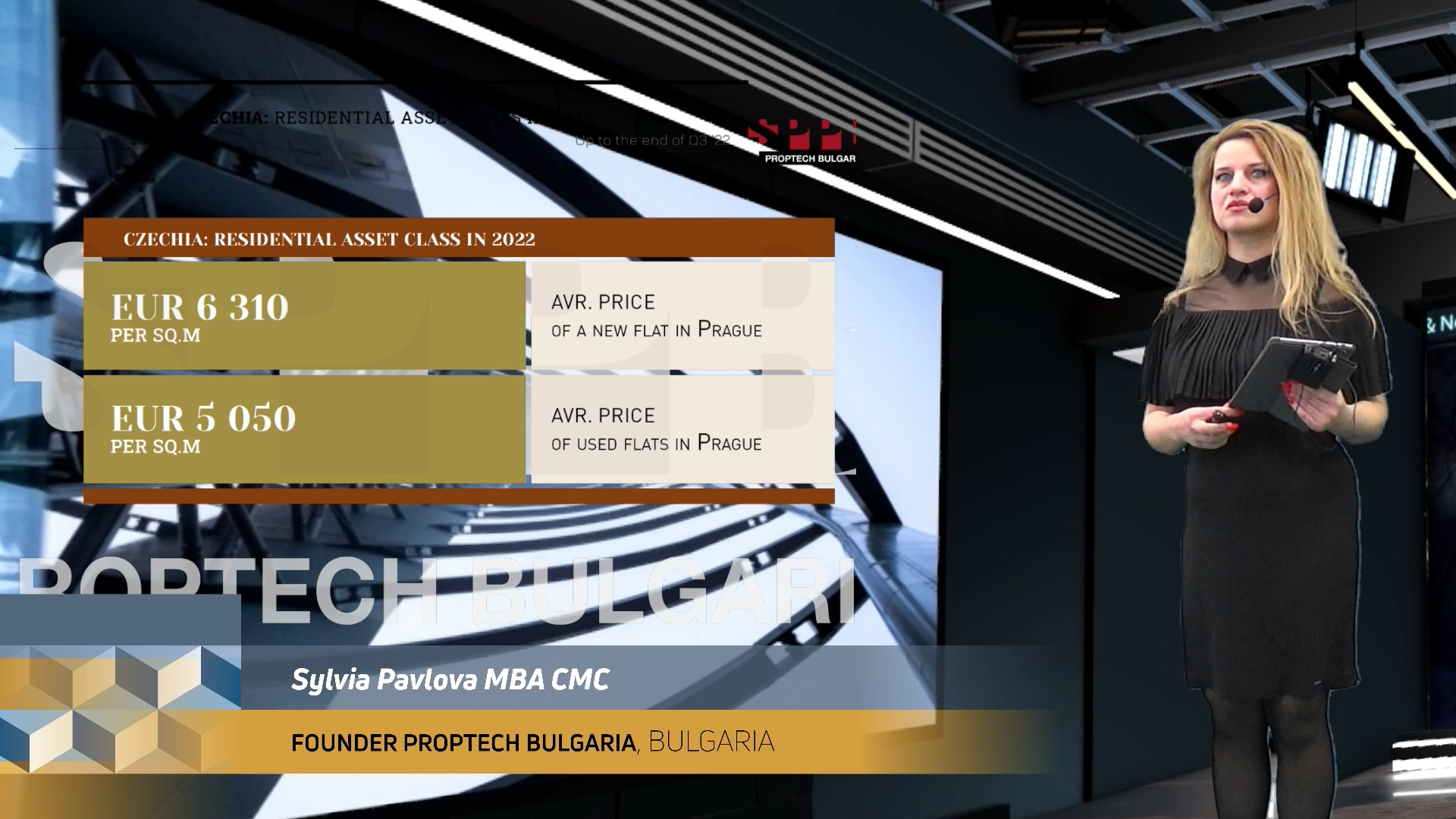

In Czechia, when it comes to residential real estate assets, Czechs are oriented largely towards an ownership model. The ratio of owner-occupied to rented apartments in Prague, for example, is approximately 70:30, similar to the EU27 average. Still, the Czech Republic is somewhat behind more advanced markets in terms of market evolution towards new trends. However, with the shift to hybrid working, intense talent searches, and the growth of the business services sector, Prague and other large Czech cities will need more flexible housing solutions soon. The average bid price for a newly built apartment in Prague was approximately CZK 155,000 per square meter during Q3 2022. This represents an increase of 7% since the start of the year, according to an analysis done by Colliers.

Leave A Comment