OFFICE ASSET CLASS: December 2022 CSEE NEWS

Due to strong Q1 activity, partially spilling over from last year, investment volumes for the first three quarters of 2022 totalled €7.5 billion. Year-end 2022 volumes could reach between €9.0 and 10.0 billion, reveals a report by Colliers.

CEE flows by sector

The office sector continued to hold on to the top spot with a 38% share of Q1-Q3 2022 volumes. Logistics remains in high demand but is held back by a lack of products. Retail saw the shares in two large portfolios change hands. Otherwise, we still record a lot of interest for PRS/Living assets however they also remain in short supply. With much higher mortgage rates and falling sales, we may see developers switching towards rental products.

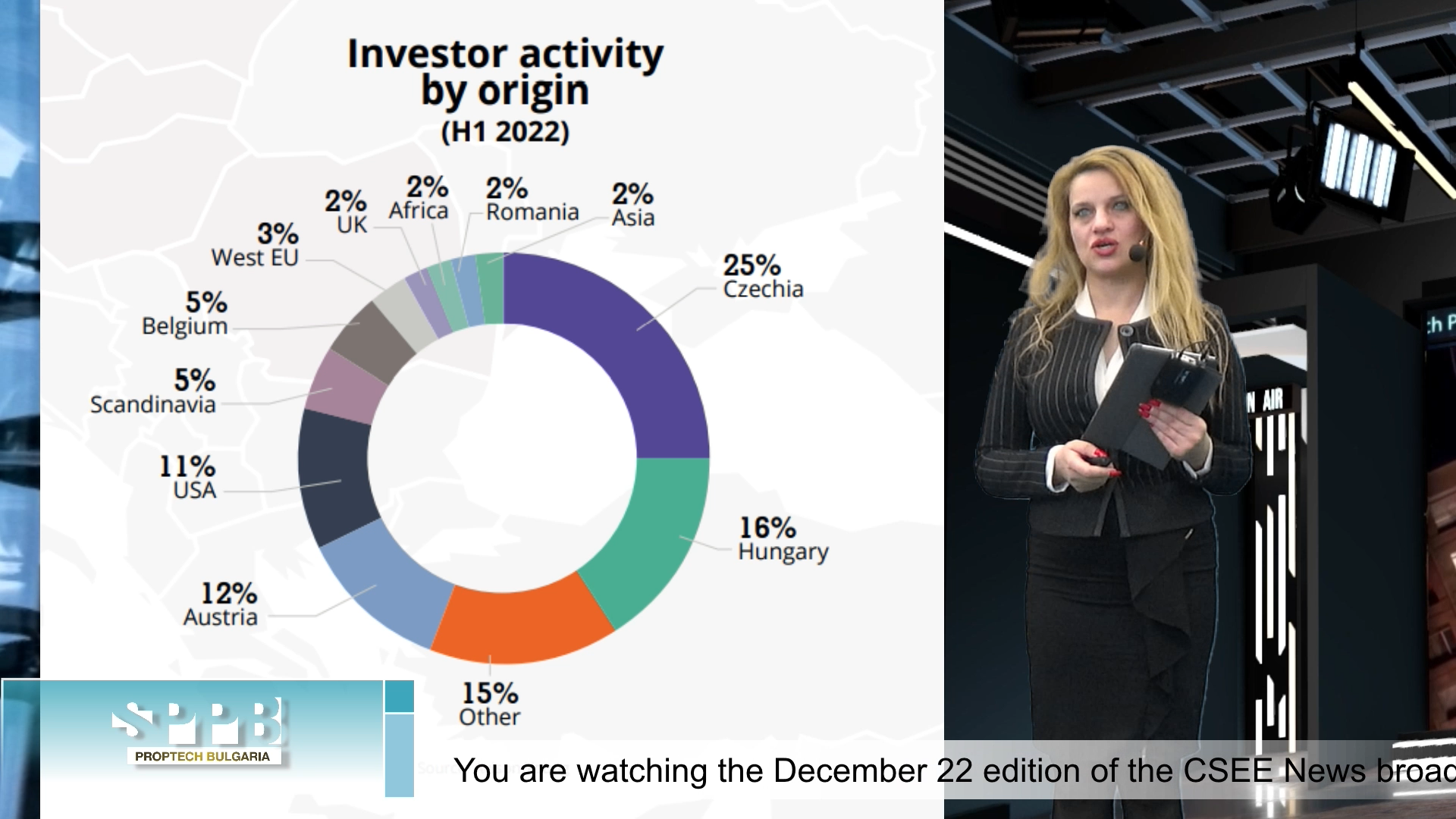

CEE flows by origin of buyer

CEE domestic capital has been the most active so far in 2022, with a 35% share of total volumes. Czech and Hungarian capital continue their drive with 19% and 10% of the total regional volume, respectively. Capital from CEE combined was responsible for over 10% of volumes in Poland.

Hungarian capital investing in Hungary was at 80% of its volumes and Czech Capital was responsible for 56% in its own market. This was followed by North American (27%) and European (22%) capital, although in general we have recorded a slowdown or hold pattern from international capital while pricing corrects.

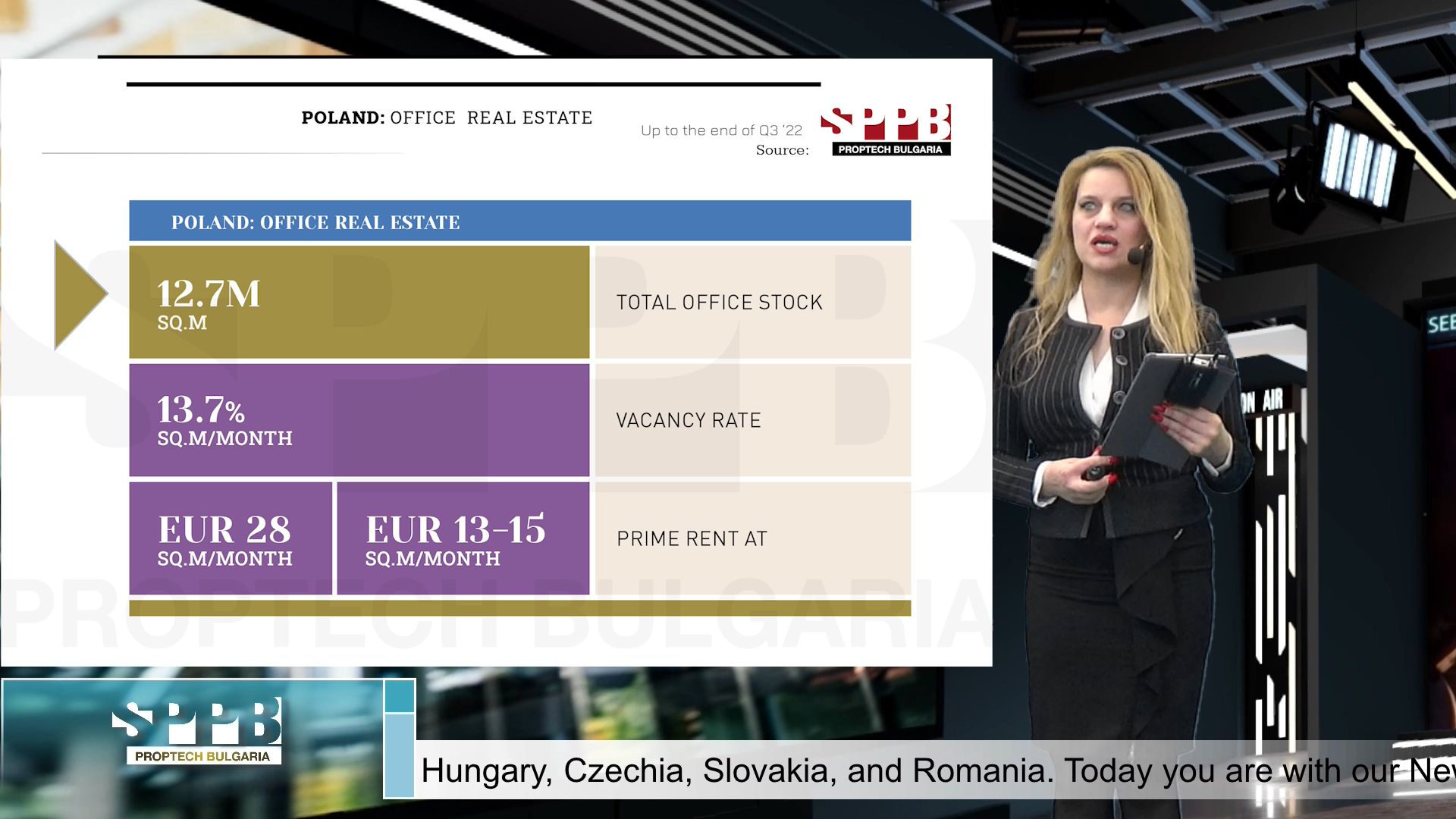

As for Poland, PINK has published figures on office market in Warsaw for Q3 2022. The data is sourced from advisory companies from the commercial real estate sector (BNP Paribas Real Estate, CBRE, Colliers, Cushman&Wakefield, JLL, Knight Frank, Newmark, Savills) and includes information on modern office stock, new completions, take-up volumes and vacancy rates.

- At the end of September 2022, the total modern office stock in Warsaw accounted for 6,343,000 sqm.

- In Q3 2022, approximately 99,100 sqm of modern office space was delivered to the capital city market in three projects, i.e. Varso Tower (63,800 sqm) located in the Central Business District, P180 (32,000 sqm) in Mokotów and Poleczki 32 (3,300 sqm) in Puławska corridor. When added to the eight office schemes completed in Warsaw in the first half of 2022, the total new supply introduced to the market since the beginning of 2022 amounted to 228,100 sqm.

- At the end of Q3 2022, the vacancy rate in Warsaw reached 12.1% (up 0.2 pp. compared to the previous quarter and decrease by 0.3 pp. in relation to the comparable period in 2021). Availability of office space equalled 770,200 sqm. In central zones, the vacancy rate dropped to 11.1%, while outside the city centre it reached 13.0%.

- SEE ALL THE INFORMATION ON POLAND HERE

The office leasing market in Romania has recorded a fall of 18% in gross take up in the first half of 2022 compared to the same period of last year, although Bucharest has seen a slight increase, according to a report by real estate consultancy JLL Romania.

Timișoara had by far the largest share in office leasing across regional cities with almost 20,000 sqm, or approximately 54% of total office transactions in major regional cities. The second largest market is Iași, with 10,500 sqm, followed by Cluj-Napoca and Brașov.

Demand for offices in large cities outside Bucharest was dominated by IT companies that had a share of 60% of the leasing activity.

“The real estate market in the regional cities continues to mature and remains attractive for companies in the pursuit of new talent pool and competitive wages, while accommodating millennials migratory patterns. Encouraged by the adoption of new ways of working, co-working and flexible office space schemes are expected to emerge in the regional landscape in the coming period,” said Mădălina Iconaru, Consultant Office Agency JLL Romania.

In Czech Rep. the office market is increasingly leaning towards the tenant side. Flexibility and sustainability play a major role.

Demand for new office projects in attractive locations will continue to rise (up 41% y-o-y in Prague in H1), while changes in the way offices are used towards a hybrid working model will lead to a greater interest in flexible offices. According to the “EMEA Office Occupier Sentiment Survey 2022”, this is due to, among other things, the desire to reduce capital expenditure by companies, to respond flexibly to current changes and the ability to enter new markets. At the same time, the gap between rents in new premium offices and B offices will also widen.

From the beginning of the year until June, 47,880 sqm of new office space has been completed in Prague (56% of which has already been pre-leased) and a further 28,800 sqm in 6 different projects will be completed by the end of December. Quite a few new and attractive office buildings are expected to come to the Prague market in 2023. This, combined with slowing demand and the fact that almost no new companies are entering the Prague market, may lead to an increase in overall vacancy next year – it is currently around 8% (8.5% in class “A” offices and 8% in class “B” offices). So even though new premium office space is no longer being offered below EUR 14.50-15 per sqm per month, the market is becoming a “tenant’s market” in many locations and especially in Prague, with landlords having to come up with incentives in many projects.

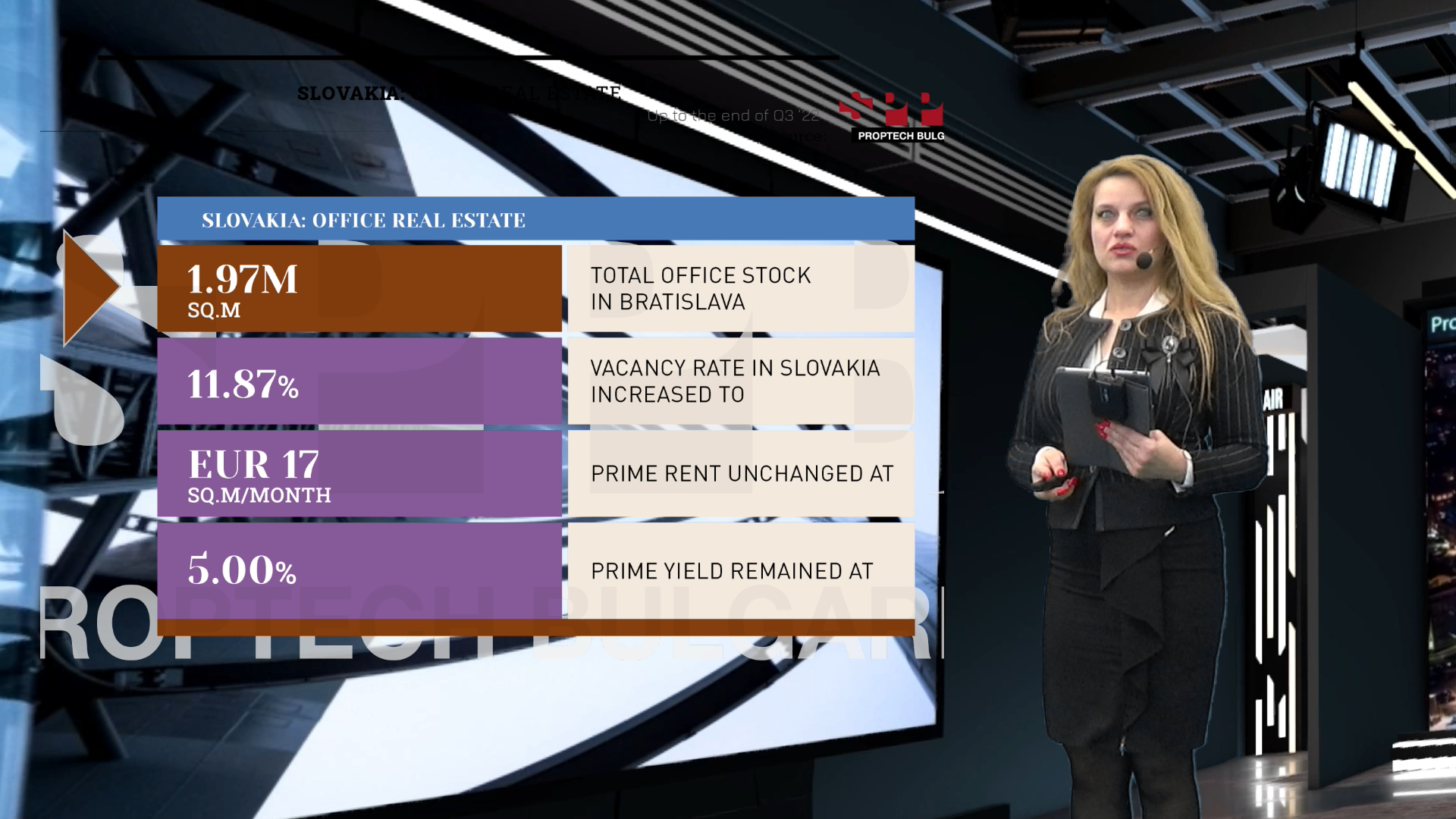

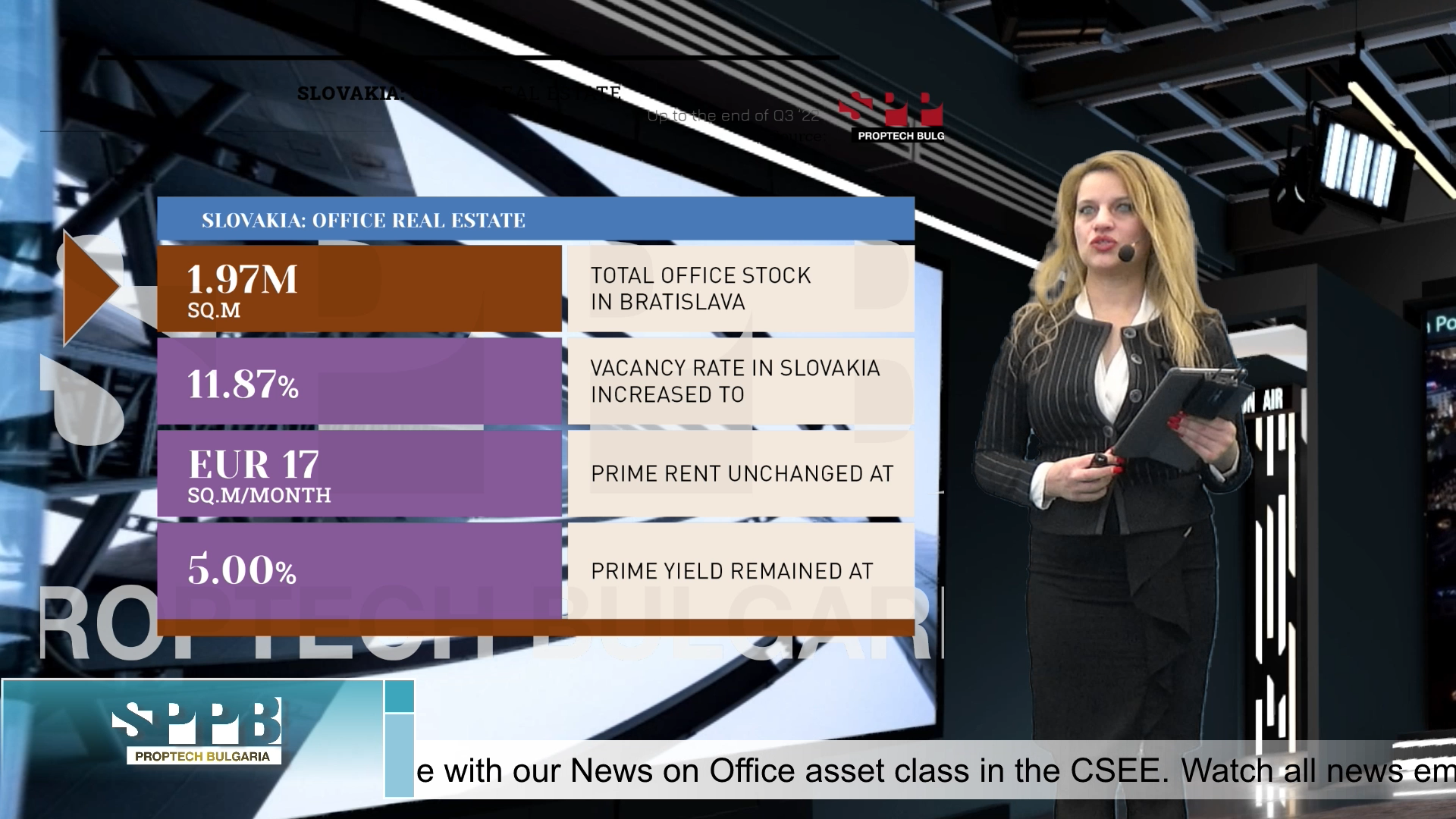

In Slovakia after a minor slowdown in the summer, the situation regarding leasing activity was cleared up and, in many cases, we witness restored demand. Therefore, take-up reached 38,800 sqm representing a 53% quarter-on-quarter increase. In addition, net take-up figures stand at 32,400 sqm with new leases accounting for more than 26,700 sqm. We expect the increased leasing activity to persist towards year-end. However, due to the rising costs of projects, we noticed that the office market is moving towards longer required rental contract periods by landlords, which is more and more in contrast to the flexible requirements by tenants. As a result, the vacancy rate rose mildly to 11.87%. In favour of vacancy was the completion of Lakeside Park 02, which brought fully leased space of 14,000 sqm. Altogether, development activity is slowed down this year, as only about 3,500 sqm of leasable space will be added next quarter, bringing the year’s total to 28,600 sqm. On the other hand, most of the projects will come on stream in 2023 representing 48% above the five-year average.

To cope with elevated energy and input costs, landlords continued in increasing service charges. Less energy-efficient buildings, mostly older B and C-class buildings, were affected the most. Therefore, the competitive advantage will go to the higher-end buildings with better energy efficiency. Still, many buildings have energy contracted only until the end of the year exposing themselves to the risk of purchasing energy at spot prices. As a result of high costs combined with popularity-gaining home offices, the trend of reducing space is ever more visible on the market. Therefore, the usage of workplace and space optimization strategies is sought after. Prime rent and prime yield remained unchanged at €17/sqm/month and 5.00%.

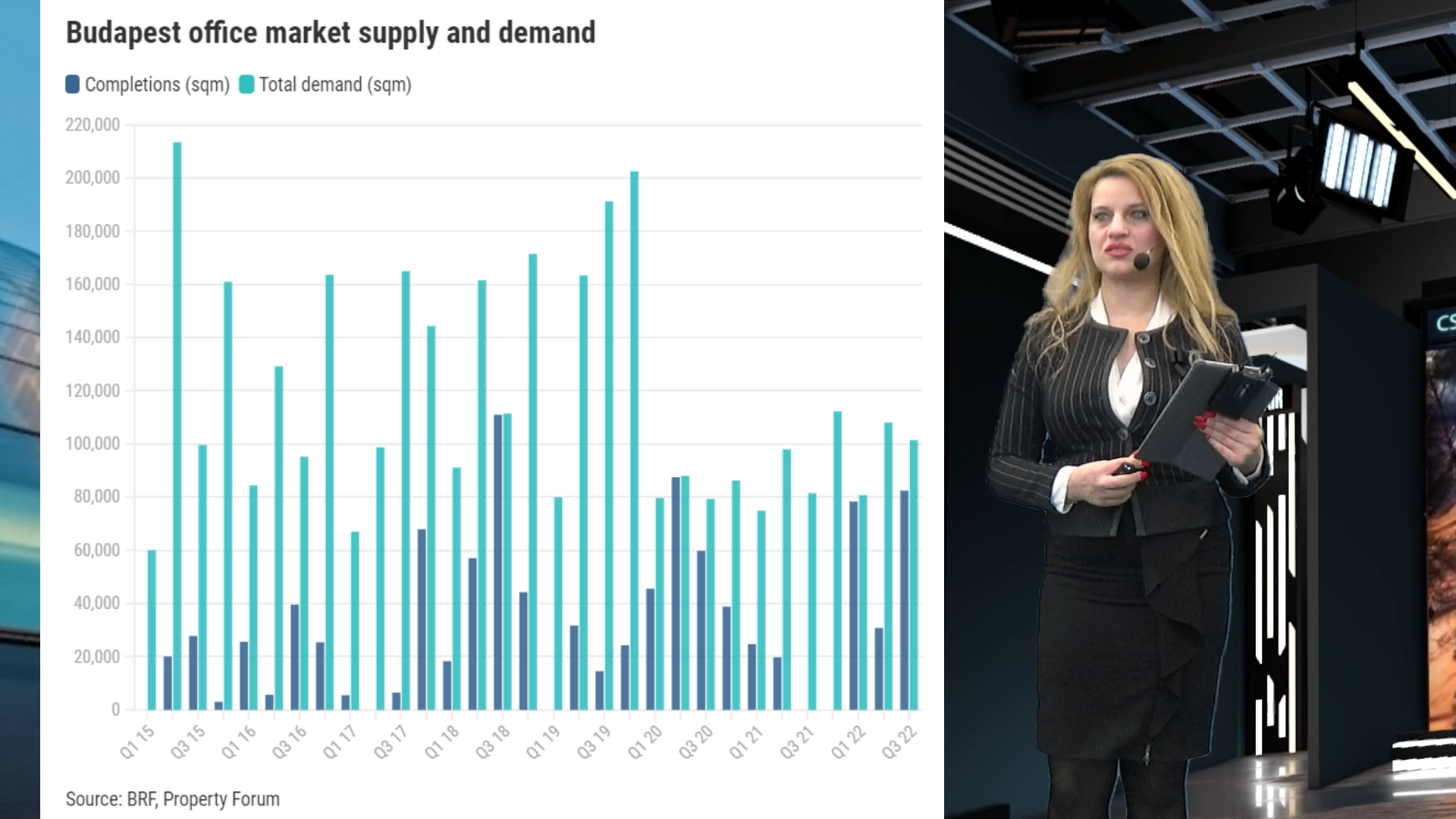

Regarding Hungary, in Q3 2022, the volume of new supply in Budapest’s office market increased significantly compared to the previous quarter, marking the highest volume since Q2 2020, the Budapest Research Forum (BRF) reports.

The total modern office stock currently adds up to 4,175,670 sqm, consisting of 3,452,300 sqm of Class A and B speculative office space as well as 723,370 sqm of owner-occupied space.

In the third quarter of 2022, four new office buildings were delivered to the Budapest office market with a total of 82,420 sqm, the new owner-occupied Bosch Campus II building with a size of 17,130 sqm, Millennium Gardens with a size of 20,060 sqm, Budapest One II. and III. phase (37,950 sqm) and Major Udvar with a size of 7,270 sqm. Three buildings (total size: 11.760 sqm) have been moved to the owner-occupied stock.

Leave A Comment