RETAIL ASSET CLASS: December 2022 CSEE NEWS

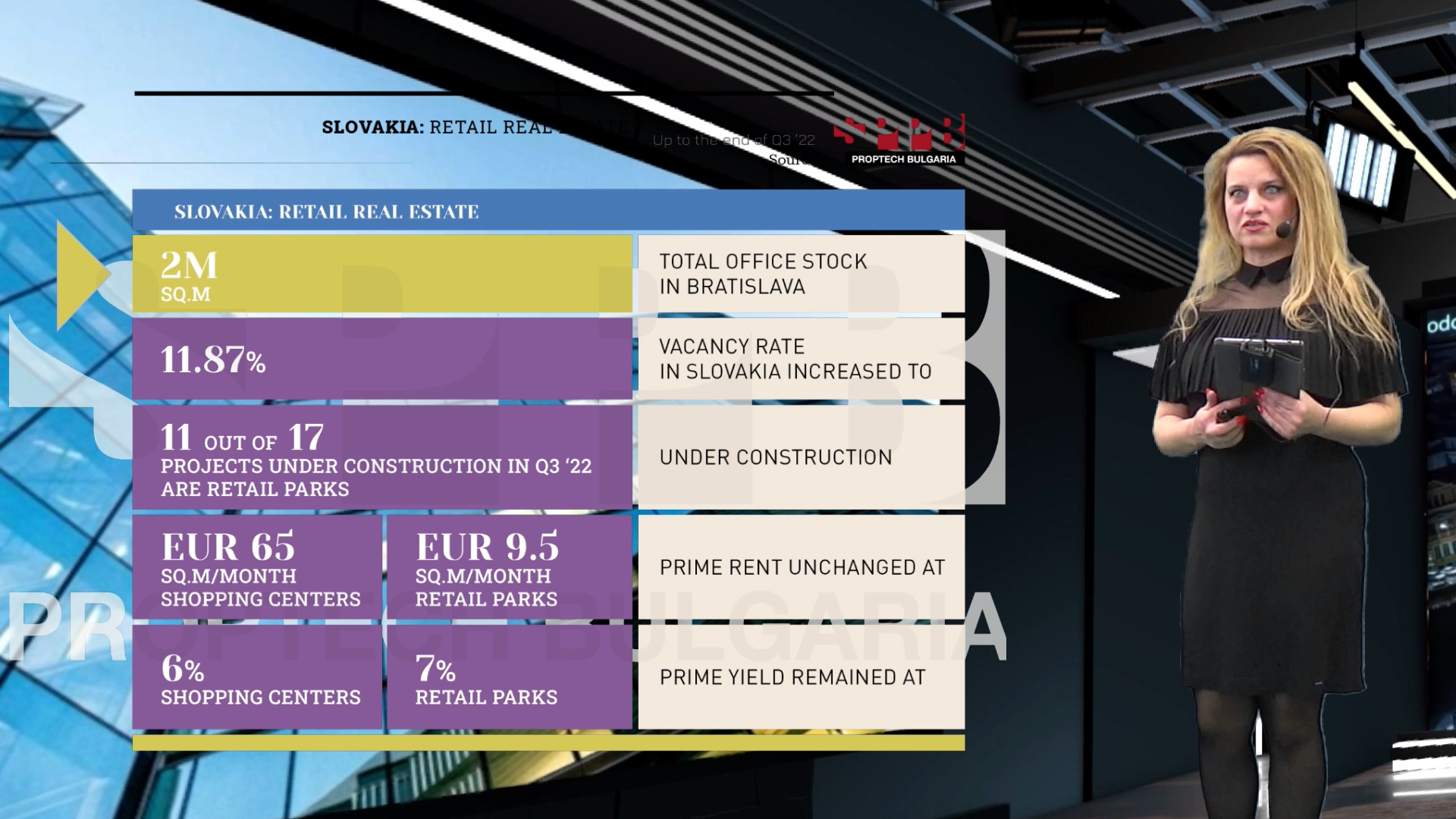

In Slovakia, cautiousness among retailers keeps increasing as they face an unprecedented situation. Increases in construction costs resulted in delays in the delivery of projects under construction and/or postponement of planned ones. Despite this fact, developers have been announcing new projects in less saturated regions. Although we did not see any new completions in Q3, more than 109,000 sqm of retail space is scheduled for completion in 2022-2023. Retail parks dominate the current pipeline and account for 11 out of 17 projects under construction. The rest consists mostly of extensions of existing schemes including the Eurovea II with 25,000 sqm in Bratislava and OC Madaras with 10,000 sqm in Spišská Nová Ves and several small schemes of regional significance. Slovak market currently comprises more than 2 mil sqm of retail space, whereas shopping centres make up more than 67%, retail parks account for 27% and the rest goes to mixed-use schemes.

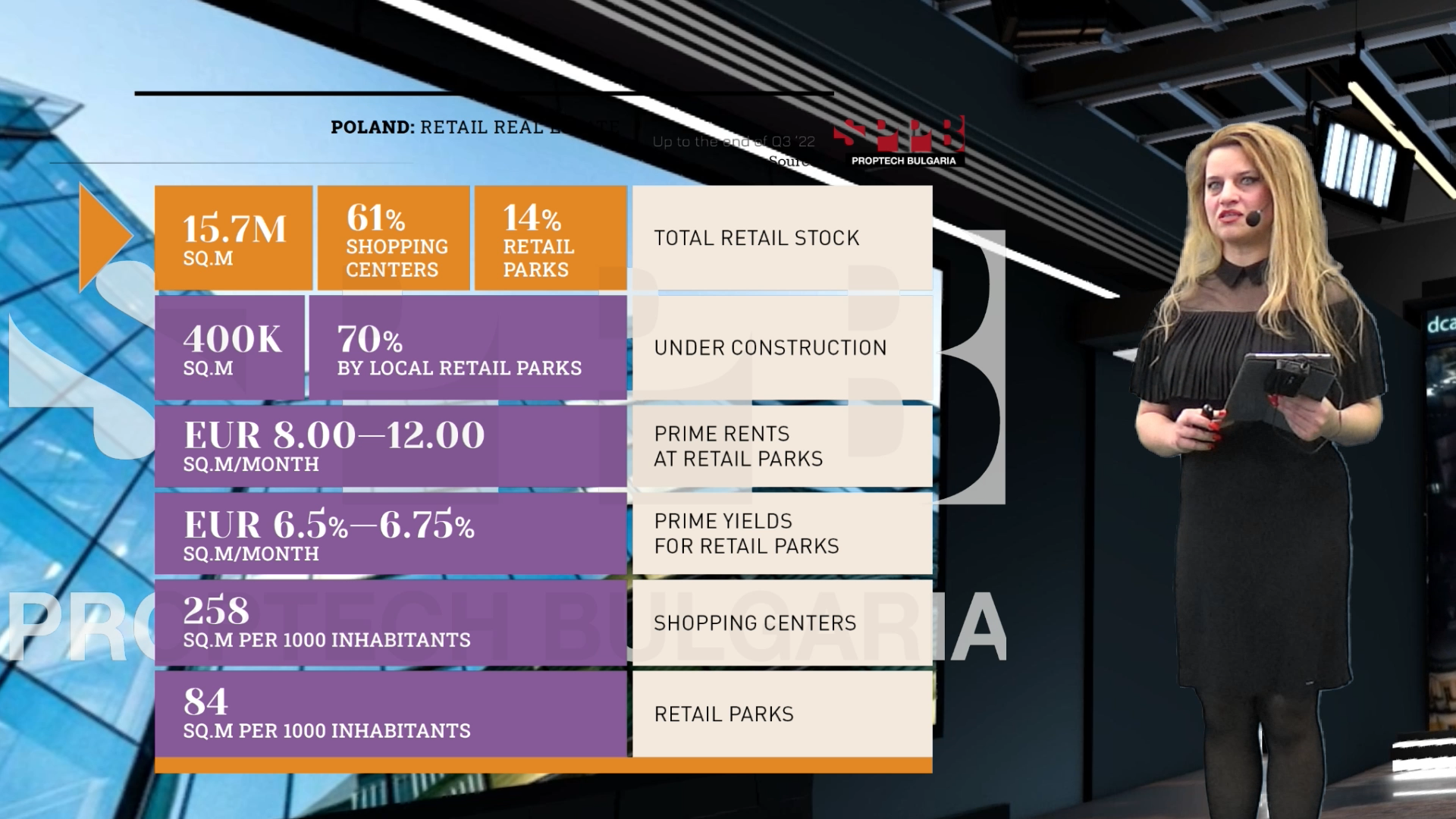

In Poland, Retail parks are growing in smaller Polish towns, mixed-use facilities and new residential estates provide commercial space in large cities, says Walter Herz.

Although shopping malls are busy again with crowds of customers, especially on weekends, stationary retail is becoming more and more fragmented and local. On a daily basis, the commercial market is shared between everyday shopping centres, retail parks, various types of mixed-use facilities, shops located on the main city routes and shopping malls, which are more and more often appearing in new residential estates. The future belongs to the shops that are located close to home. For over two years, small local shopping centres and retail parks have been gaining in importance, and they are currently dominating among the investments carried out in the sector.

For over two years, small local shopping centres and retail parks have been gaining importance, and they currently dominate the investments carried out in this segment. The market needs inspired Walter Herz to expand its operations in the area of searching, preparing and obtaining permits for land for sector investments of various scales.

In Czechia, shopping centres have fallen on hard times. The market expects a recovery in investment activity and new construction

This year, 11,200 sqm will be newly added to the market – one new shopping centre (OC Javor) will be completed and Atrium Palace Pardubice will be expanded. And although several other shopping areas will open across the country in 2023 and 2024 (e.g. OC Galerie Pardubice, but there will also be an expansion of Centrum Černý Most in Prague, Šantovka in Olomouc or Varyáda in Karlovy Vary), the retail segment will see the most retail park construction in the coming period. These have been very successful during the period of Covid and this trend will continue, also due to rising inflation, along with the expansion of discount chains. The catering sector, on the other hand, will face major challenges, as it was one of the most affected segments during the lockdowns and the associated anti-poverty measures: all this has had an impact on it and may result in the closure of some establishments and thus a reduction in supply.

In Romania, With a rent level of €53/sqm/month on Calea Victoriei, the main retail street of the city, Bucharest remains in the top 50 cities analyzed worldwide and in position 46 out of 53 in the EMEA ranking, just behind Warsaw, according to a report by real estate consultancy Cushman & Wakefield Echinox.

Leave A Comment